After long lockdowns in China, some of the trends we've seen in the west are now starting to take hold in an economy that is less focused on impulsive material acquisition, and increasingly willing to spend their money on good customer experiences and responsible, transparent brands.

Here are our 3 top highlights from PWC’s Global Insights Report.

Customisation

Technology-assisted retail is on the rise.

We’ve already shown Augmented Reality examples in-store, such as virtual make up booths. Now it’s the turn of ecommerce with outlets providing AI-driven chatbots to achieve service at scale.

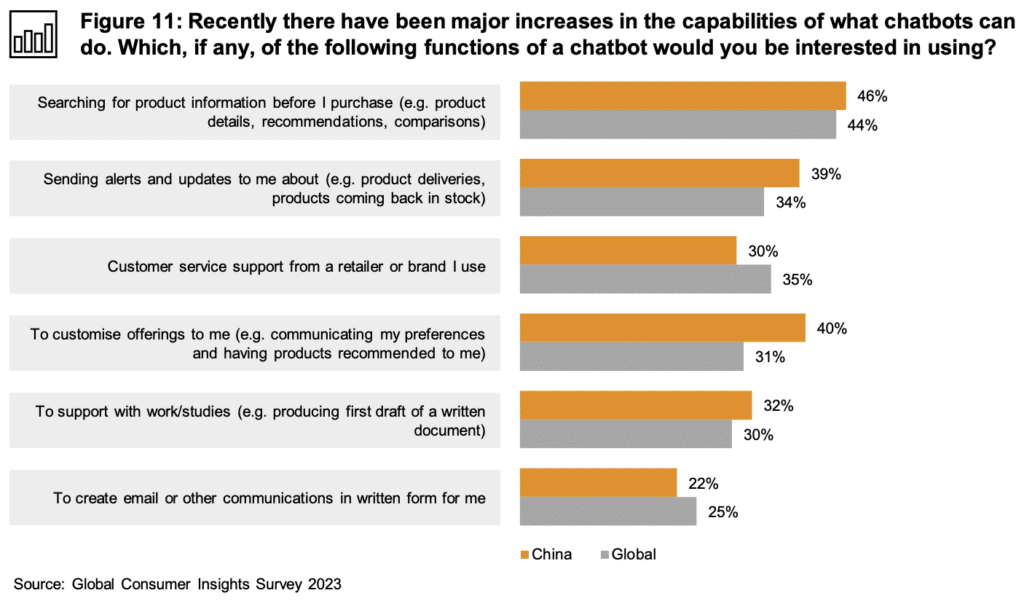

Chinese consumers are more interested than other countries in using chatbots for product research, and making personal recommendations about product choices:

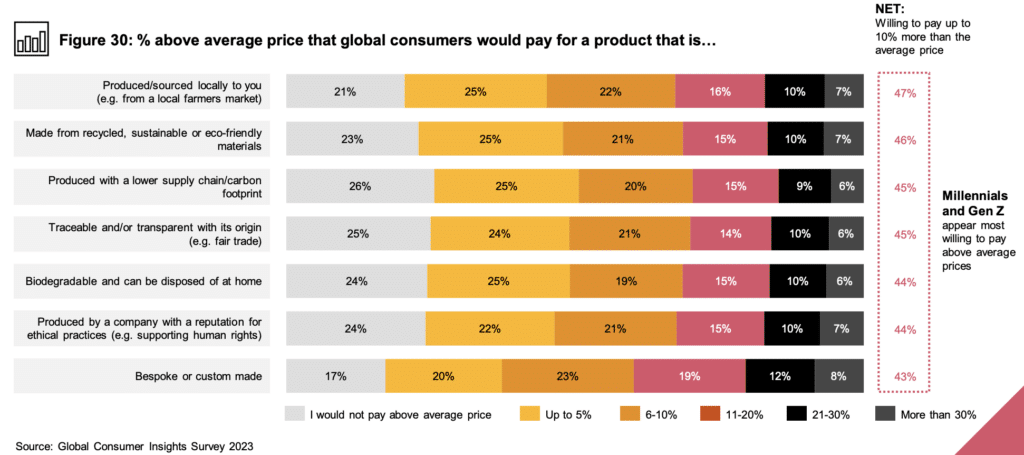

28% of Mainland China also said they’d pay 20% or more for goods that were bespoke or custom made. This is one of the highest percentages in the world.

Interestingly, Hong Kong is one of the lowest, showing the stark differences between consumer habits in the two parts of the country.

Data & Transparency

PIPL – the Chinese data protection law, took effect in late 2021, and companies gathering data from Chinese citizens need to start taking notice of it.

33% of Chinese consumers said they were concerned about how social media companies use their data, and 22% had the same feelings about consumer companies.

Despite that, Chinese consumers are more likely to use social platforms and large retail platforms (like Taobao) to research purchases, compared to other countries. They’re also more reliant on customer reviews than other countries.

Chinese citizens will become more used to seeing more detailed information on how and where their data is being used, and businesses that make use of consumer data need to stay ahead of this.

Sustainability

Chinese consumers are now increasingly willing to pay more for products that are sustainable, have low environmental impact, and are transparent about their sourcing.

Sustainability exists both in how products are made, and how they’re disposed of once they’re used.

Some examples of campaigns that have led the trend are:

Unilever China: Placed bottle recycling units in high footfall areas such as college campuses, and ran digital ads on them to tie in to the feel-good moment of recycling.

LVMH: Partnered with startups to reycle both manufacturing waste and excess stock.

Haier and Midea: These two consumer appliance companies ran green product events with Tmall and JD to highlight energy efficiency.

As well as FMCG companies taking part in these campaigns, there are significant opportunities for green B2B businesses able to help Chinese business with their supply and manufacturing chains, and with recycling technologies.