Navigating the cultural complexities of China is tricky but with huge rewards at stake. This is our roadmap to successful marketing in the region.

Table of Contents

Introduction

When we meet businesses who are struggling to grow sales in China, it’s often because they’ve imported the same ideas and campaigns from their global activities.

Sometimes this can work, especially with heritage brands, but for most businesses it helps to make sure that they’ve got the foundations right. Make sure you’ve adapted to China where you need it, and the rest of the plan will fall into place much more easily.

Our 8C Methodology

Our market entry strategy is broken down into 3 phases with a total of 8 parts:

- Discovery

- Context

- Competition

- Customers

- Company

- Strategy

- Communications Plan

- Channel Plan

- Execution

- Campaigns

- Continuous improvement

In this guide, we’re going to use this 3-phase framework to walk you through how to build and execute on a China Marketing Strategy for a B2B enterprise.

Discovery Phase

The first step is understanding what you’re doing already, and what you’re up against.

This is what will help you make decisions about how to position your business against local competition when we get to the comms plan.

Context Analysis

Our first C is the biggest one, looking at the overall market context.

China is a political beast, with radically different language and culture, even compared to the rest of East Asia, so making use of local knowledge is essential.

Political and Economic Environment

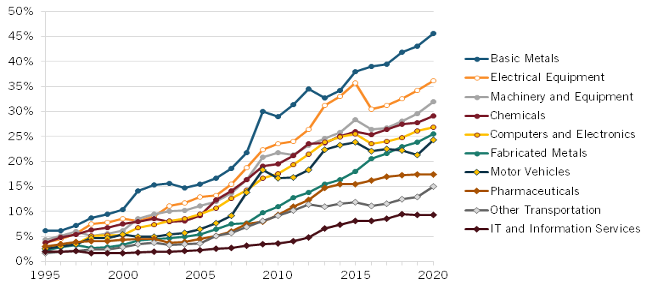

China’s rapid economic growth and transformation into a global powerhouse offers unprecedented opportunities for B2B brands across various industries. The country has reached a new stage in its economic development, with significantly enhanced innovation capabilities in its universities and domestic companies. The government’s emphasis on infrastructure development, digitalization, and industrial upgrading has created strong demand for advanced products and services across multiple sectors.

The Belt and Road Initiative (BRI) represents a major opportunity for companies specializing in construction, engineering, energy, and transportation. Global firms in these sectors can benefit from both domestic projects and international initiatives connected to the BRI. The government’s industrial policies, particularly “Made in China 2025,” are driving a significant shift from low-cost manufacturing to high-tech, advanced manufacturing.

China’s rapid economic growth and transformation into a global powerhouse offer a wealth of opportunities for B2B brands across various industries. China has reached a new stage in its economic development, with much greater innovation capabilities in its universities and domestic companies—and on many innovation indicators. The country’s emphasis on innovation, digitalization, and infrastructure development has created a strong demand for advanced products and services. Here are the key opportunities that global B2B brands can capitalize on in China:

- Infrastructure Development and Industrial Upgrading

China’s focus on infrastructure development is a key pillar of its economic strategy. The “Belt and Road Initiative” (BRI), which aims to improve infrastructure connectivity with other countries, presents significant opportunities for foreign companies specializing in construction, engineering, energy, and transportation.

- Opportunity: B2B brands involved in heavy machinery, industrial tools, energy solutions, and construction materials can benefit from large-scale projects in China and overseas markets connected to the BRI. China’s industrial upgrading plans also provide opportunities for companies involved in automation, robotics, and advanced manufacturing.

2. Healthcare and Medical Innovation

With an aging population and increasing healthcare demands, China is rapidly expanding its healthcare system and adopting advanced medical technologies. The COVID-19 pandemic further accelerated investment in the healthcare industry, including biotechnology, pharmaceuticals, medical devices, and health services.

- Opportunity: B2B brands specializing in cutting-edge medical devices, diagnostic tools, telemedicine, and healthcare software can tap into China’s growing demand for high-quality healthcare solutions. Collaborating with local hospitals and healthcare providers can offer entry into this expanding market.

3. China’s drive for advanced manufacturing

making a significant shift from low-cost manufacturing to high-tech, advanced manufacturing. The Chinese government’s industrial policies, such as “Made in China 2025,” aim to upgrade the country’s manufacturing capabilities, with a focus on high-end technology, smart manufacturing, and innovation. This transformation creates a wealth of opportunities for foreign B2B brands that specialize in advanced manufacturing technology.

- Opportunity: Companies offering advanced solutions in robotics, IIoT, precision engineering, and green manufacturing can capitalize on China’s demand for cutting-edge technology, collaboration in R&D, and the need for expertise in upgrading local manufacturing capabilities. With government incentives and a growing appetite for innovation, foreign firms that navigate local challenges and build strong partnerships can thrive in this rapidly evolving market.

4. Focus on Sustainability and Green Technologies

China has made sustainability a priority, with ambitious goals to reduce carbon emissions and transition to renewable energy sources. This creates opportunities for B2B companies that offer sustainable solutions across industries such as energy, manufacturing, and agriculture.

Opportunity: B2B brands offering green technology solutions—such as renewable energy, energy-efficient machinery, waste management, and sustainable agriculture—are well-positioned to grow in China. The government’s emphasis on carbon neutrality and clean energy presents an attractive market for companies that can support sustainability efforts.

Regulatory Landscape

China’s regulatory environment is complex and subject to frequent changes that can significantly impact business operations. Foreign businesses must navigate various laws and regulations, including intellectual property protection, data privacy, product standards, and foreign investment restrictions. The Personal Information Protection Law (PIPL) has introduced strict requirements for how businesses collect, store, and use personal data.

Companies must be particularly attentive to industry-specific advertising regulations that can limit marketing activities on certain digital platforms. Regulatory approvals for sectors like healthcare and technology can be time-consuming and require extensive local expertise. Working with local legal counsel and consultants who specialize in China’s regulatory framework is essential for ensuring compliance.

Competitive Analysis

Competitive Landscape Assessment

The Chinese B2B market is characterized by fierce competition from both domestic and international players. Local companies often have significant advantages in terms of market insight, established relationships, and the ability to offer lower-cost solutions. Chinese competitors frequently outpace foreign brands in terms of price and speed to market, requiring international companies to find other ways to differentiate themselves.

Technology adoption among domestic competitors is typically very advanced, particularly in digital marketing and e-commerce capabilities. Local firms have sophisticated understanding of Chinese social media platforms and are skilled at creating engaging content that resonates with local audiences. They also tend to have strong networks within industry-specific communities and professional associations.

A thorough analysis of key competitors should examine their brand identity in China, market position, and overall sentiment among target customers. This assessment should include a detailed evaluation of their key messages, proof points, and reasons to believe. Understanding competitors’ digital footprints across various platforms provides insight into successful engagement strategies.

Special attention should be paid to competitors’ content pillars and promotion strategies across different channels. Analysis should include examination of their sales journeys and how they nurture leads through various touchpoints. Identifying best practices among competitors can inform strategy development while highlighting opportunities for differentiation.

Relationship-Driven Business Culture

In China, business relationships play a critical role in building trust and closing deals. Unlike Western markets, where decision-making can be faster and more transactional, Chinese companies often prefer to build long-term relationships with partners before making major business commitments.

Brands who are unfamiliar with the importance of business relationships may struggle to build trust with local stakeholders and secure business deals. Decision-making processes can be slower and more complex, involving multiple levels of approval.

New entrants should invest in relationship-building by attending industry events, engaging in face-to-face meetings, and maintaining regular contact with key decision-makers.

Patience and persistence are key to developing long-term business relationships in China.

Customer Segmentation

Identifying stakeholders and how Chinese businesses approach decision-making

Chinese B2B buyers typically involve multiple stakeholders in purchasing decisions and prefer to build long-term relationships with partners before making major commitments. The decision-making process tends to be slower and more complex than in Western markets, involving multiple levels of approval. However, once relationships are established, implementation can move very quickly.

Understanding the unique aspects of Chinese business culture is crucial for effective customer segmentation. Personal connections and trust play a critical role in building business relationships, and decision-makers respond better to personalized, relationship-driven approaches rather than purely transactional interactions.

Information Gathering

B2B buyers in China use a wide range of channels for gathering information and evaluating potential partners. They expect to find comprehensive information about companies across multiple platforms, including professional social media, industry forums, and traditional business channels. The research process is typically thorough and involves both online investigation and personal recommendations from trusted sources.

Strategy Development

A set of common misconceptions are a drag on their ability to generate leads, build relationships, and create brand awareness effectively.

Misunderstanding #1: Copy-Paste Competitor Analysis from Other Markets

- What They Assume: Competitors in China will behave similarly to how they do in global markets.

- Reality: Domestic competitors often have stronger local knowledge, lower costs, and more established networks. Distribution is almost always better than new global entrants.

- Solution: Conduct in-depth research on local competitors and focus on differentiating your brand through superior customer support, technical expertise, and long-term service agreements.

Misunderstanding #2: The Same Customer Journey Applies

- What They Assume: The customer journey in China follows the same linear path as in other markets.

- Reality: The decision-making process in China is highly influenced by personal connections, industry reputation, and peer recommendations.

- Solution: Build trust through referrals, case studies, and thought leadership. Ensure multiple touchpoints across the funnel to nurture leads at each stage.

Misunderstanding #3: “Global” Messaging WIll Be Effective

- What They Assume: A single global marketing message can be translated and used across all markets.

- Reality: Chinese B2B buyers value personalized communication and culturally relevant messaging. Generic content fails to resonate.

- Solution: Localize marketing messages by focusing on the specific needs, industry challenges, and cultural values of Chinese businesses. Use in-depth market research to understand your audience and create compelling content tailored to different stages of the buyer’s journey.

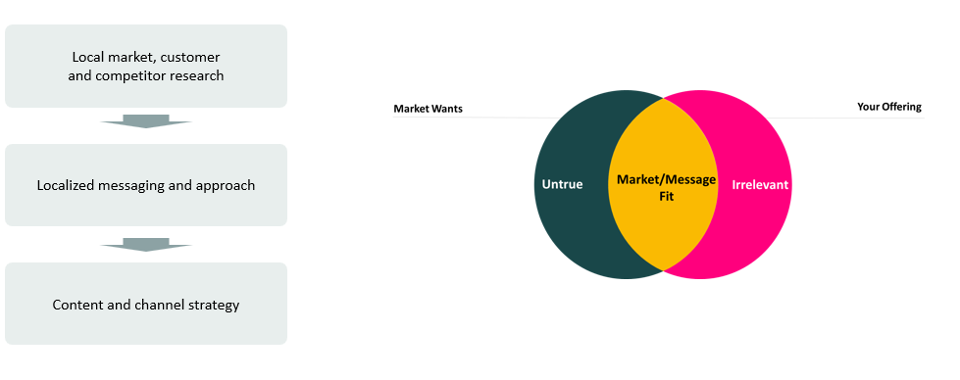

Here’s how we translate these fixes into a communications plan:

Competitive Advantage Definition

Understanding how we sit relative to our competition will help us to position ourselves as “different” but in a way that’s meaningful to the customer:

Value Proposition Development

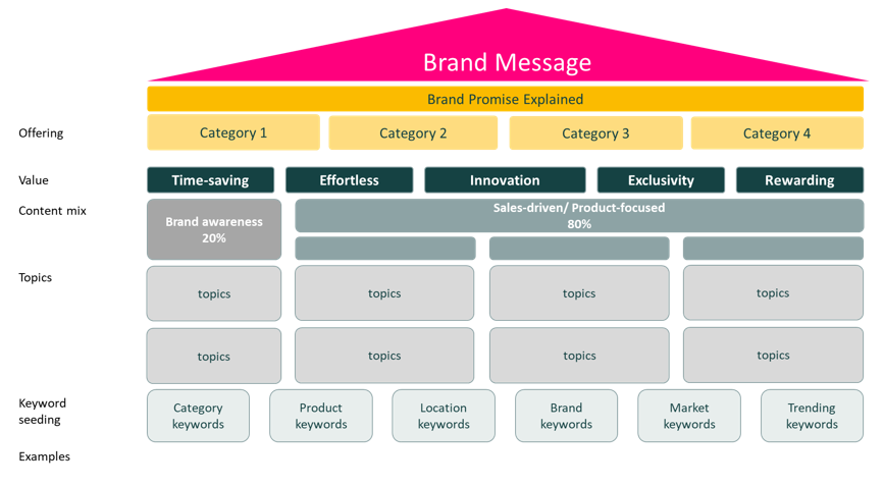

Companies must differentiate themselves through superior quality, reliability, and long-term value rather than competing solely on price with local firms. Global experience and expertise should be highlighted while demonstrating understanding of local market needs and challenges. Technical superiority and innovation capabilities need to be communicated in ways that resonate with Chinese buyers’ specific pain points and industry challenges.

Message Localization

Marketing messages must be carefully localized to reflect Chinese business culture and values, going beyond mere translation. Generic global content typically fails to resonate with Chinese B2B buyers who value personalized communication and culturally relevant messaging. Success stories and case studies should be adapted to highlight aspects most relevant to Chinese businesses, with particular attention to local industry challenges and solutions.

The comms strategy is encapsulated in the “Messaging House” that flows down from a single brand message, through each business segment, channel and tactic, right down to keyword targeting in search engines and social search content:

Channel Plan

The channel strategy means identifying where your customers are most receptive to your marketing messages, and what formats are appropriate to can use on each one.

The Chinese Digital Ecosystem

An effective omni-channel strategy is crucial, with WeChat serving as the hub for customer relationship management and content distribution. Recent data shows that 94% of B2B marketers consider social media their top channel, while 86% still value offline events, demonstrating the importance of an integrated approach. The misconception that WeChat alone is sufficient for success has led many companies to underutilize other valuable channels.

Key Channels in an Omni-Channel Strategy:

- WeChat: As one of the most important tools for CRM, content distribution, and direct engagement, WeChat serves as a hub for managing customer relationships and nurturing leads. Brands can publish long-form content, communicate directly with followers, and use mini-programs for services like appointments or product showcases.

- Baidu: China’s top search engine is critical for driving inbound traffic through SEO and PPC. By optimizing your website content for Baidu and investing in paid search, you can capture top-of-funnel traffic and educate potential leads about your products and services.

- Toutiao, WeChat Video Channel, Douyin: Short-form, high-impact videos can be used to demonstrate product features, share customer testimonials, or highlight company innovations, which can attract new leads and build brand awareness.

- PR and Advertorials on Mainstream Media: Establishing authority and credibility in the market is crucial. Publishing PR articles or advertorials on respected Chinese media platforms such as Sina, Tencent News, or People’s Daily can help reinforce your brand’s reputation. This approach is particularly effective for demonstrating industry leadership, showcasing success stories, and sharing insights on industry trends.

- Industry Influencers and Communities: Key Opinion Leaders (KOLs) and industry-specific influencers can help amplify your brand message, as Chinese B2B buyers often trust influencers within their field. Participating in or sponsoring discussions in industry-specific communities (e.g., forums, webinars, and professional associations) can build credibility and generate leads through thought leadership and recommendations.

- Zhihu (Chinese Quora): Zhihu is an invaluable platform for B2B marketing in China, offering brands the opportunity to build thought leadership, engage with professionals, and influence decision-makers through in-depth content. By answering industry-related questions, publishing long-form articles, collaborating with key opinion leaders (KOLs), and utilizing its communities and paid promotion options, brands can establish credibility, generate organic traffic, and nurture qualified leads.

- Alibaba and JD B2B Platforms: For direct e-commerce engagement with Chinese businesses, these platforms offer credibility and a trusted space for B2B transactions. Maintaining a strong presence on platforms like Alibaba allows businesses to connect with potential buyers who are actively seeking products and services.

- Industry Forums and Conferences: Offline engagement is equally important in China’s B2B space. Attending and sponsoring industry events, conferences, and forums helps establish personal connections and build relationships with key stakeholders. Face-to-face interactions remain an essential component of relationship-driven business practices in China.

Top Chinese Marketing Channels for B2B in 2024

Execution Framework

Campaign Implementation

Top of Funnel Activities

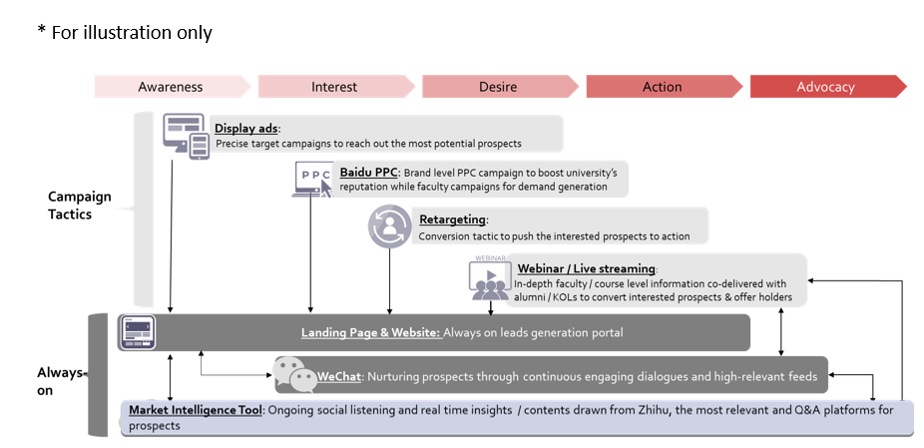

Brand awareness campaigns should utilize a mix of paid media, social platforms, and industry events. Initial engagement efforts need to focus on building credibility and demonstrating industry expertise rather than pushing for immediate sales. Content at this stage should emphasize thought leadership and market understanding.

Influencer Collaboration

Collaboration with Key Opinion Leaders (KOLs) and industry influencers is crucial for building trust and reaching niche audiences. Unlike in Western markets, Chinese B2B buyers highly trust and rely on influencers within their industries for professional insights. KOL partnerships should focus on creating authentic, value-added content that enhances brand credibility.

Middle Funnel Engagement

Educational content and technical demonstrations play a crucial role in nurturing prospects through the consideration phase. Webinars and workshops should be designed to address specific industry challenges and demonstrate practical solutions. Case studies and success stories need to be localized and relevant to Chinese market conditions.

Bottom Funnel Conversion

Lead conversion strategies must respect the relationship-driven nature of Chinese B2B sales. Technical consultations and face-to-face meetings remain crucial for closing deals, even in the digital age. Companies should maintain consistent communication through multiple channels, particularly WeChat, during the final stages of the sales process.

The Channel Plan combines always-on activity and monitoring with cycles of activation that move in waves down the funnel to sales events:

Continuous Improvement

Continually improving the campaign relies on responding to data from within the campaign, and external to the business as the competitive landscape changes.

Performance Analysis

Regular review of campaign performance across all channels helps identify opportunities for optimization. Companies should analyze both quantitative metrics and qualitative feedback from sales teams and customers. This data should inform adjustments to channel mix, content strategy, and targeting approaches.

Digital Metrics

Key performance indicators should include both traditional metrics and China-specific measurements. Important metrics include impressions/views/reads (88% of marketers track these), leads generated (80%), follower numbers (70%), and engagement metrics (56%). WeChat-specific metrics such as follower growth, article read rates, and mini-program traffic require particular attention.

Key Metrics for B2B Marketing in China

1. China-Specific Digital Marketing Metrics (and How They Differ from Western Platforms)

1.1 WeChat Metrics (Followers, Engagement, Conversion Rates)

- What It Measures: The growth in WeChat followers, user engagement (likes, shares, comments), and conversions driven through WeChat.

- How It’s Different: WeChat plays a unique role in China as both a social platform and a CRM tool. Unlike Western platforms like Facebook or LinkedIn, WeChat’s functionality includes mini-programs, direct messaging, and in-app purchases, making it a comprehensive ecosystem for managing customer relationships and driving conversions.

- Key Metrics:

- Follower Growth: Indicates brand awareness and audience building.

- Cost per follower acquisition

- Article Read Rate: Measures the number of people reading your published content.

- Conversion from WeChat CRM: Tracks how well leads convert through WeChat interactions, making it central to lead nurturing.

- WeChat Video Channel Metrics

WeChat Video Channels (视频号) is an increasingly popular feature on WeChat, allowing brands to upload short videos and live streams to engage their audience. WeChat Video Channels are becoming an effective tool for B2B brands to showcase thought leadership, product demonstrations, and industry insights.

- What It Measures: The effectiveness of video content in driving engagement, and more importantly, peer-to-peer spreading and further penetration to industry audience groups.

- How It’s Different: Integration with WeChat eco-system. WeChat Video Channels are fully integrated with WeChat’s broader features like mini-programs, CRM, and direct messaging. This allows users to seamlessly transition from watching a video to engaging with a brand, requesting information, or making inquiries, all within WeChat.

- Key Metrics:

- Video views

- Average watch time

- Engagement rate: Tracks likes, comments, and shares on your videos.

- Follower growth from WeChat Video Channel: Measures the number of new followers gained through your video content.

- Conversions from Video Channel: Tracks leads or inquiries generated from calls-to-action within your videos.

1.3 Baidu SEO Metrics (Visibility, Organic Traffic)

- What It Measures: Website traffic, visibility, and engagement from Baidu’s search engine results, focusing on SEO performance tailored to Baidu’s unique ranking factors.

- How It’s Different: Baidu’s algorithm differs from Google’s, prioritizing factors like trustworthiness and domain authority of local sites, with a preference for local hosting. Optimizing for Baidu requires different keyword strategies, site structure, and technical SEO adjustments compared to Google.

- Key Metrics:

- Baidu PageRank: Tracks the rank of your website on Baidu for relevant keywords.

- Organic Traffic from Baidu: Measures the volume of organic visits from Baidu search results.

- Bounce Rate from Baidu: Indicates how well your content engages visitors from Baidu.

1.4 Baidu PPC Performance (Click-Through Rate, Cost Per Click, Conversion Rate)

- What It Measures: Performance of paid search campaigns on Baidu, focusing on metrics like click-through rate (CTR), cost-per-click (CPC), and conversion rates for lead generation.

- How It’s Different: Unlike Google Ads, Baidu’s paid ad placements often feature more prominently in search results, but they can also have stricter ad content approval processes, and competition from local brands may differ. Baidu’s ads target Chinese search behavior specifically, making it essential to localize your keyword targeting and bidding strategy.

- Key Metrics:

- Click-Through Rate (CTR): Shows the relevance and attractiveness of your ad copy to searchers.

- Cost Per Click (CPC): Measures the cost of acquiring a click through paid search.

- Conversion Rate: Tracks how many visitors take desired actions (e.g., filling out a form or downloading a resource) after clicking on your ad.

- Cost per acquisition

1.5 Zhihu Engagement (Views, Upvotes, Comments)

What It Measures: The number of views, upvotes, comments, and leads generated through Zhihu posts or answers.

- How It’s Different: Zhihu is a platform where users seek in-depth, expert answers, making it a prime place to build thought leadership and drive B2B engagement. It differs from Western platforms like Quora, as Zhihu focuses more heavily on authority-building in specific industries and has strong SEO integration with Baidu.

- Key Metrics:

- Answer Views: Tracks how many people read your responses to questions.

- Upvotes and Comments: Measures engagement with your content, showing how relevant and valuable your answers are to the community.

- Leads from Zhihu: Tracks inquiries or traffic generated from your Zhihu content, particularly if users follow up on your provided links.

1.6 Industry Influencer (KOL) Metrics

- What It Measures: The impact and effectiveness of collaborations with influencers to drive brand awareness, engagement, and lead generation.

- How It’s Different: Collaborating with Key Opinion Leaders (KOLs) or industry influencers is a common strategy in China to build trust and reach niche audiences. Unlike in the West, where influencers are often associated with consumer brands, Chinese B2B buyers also highly trust and rely on influencers within their industries for professional insights.

- Key Metrics:

- Reach and Impressions: Measures how many people have seen the KOL’s post, article, or content promoting your brand. This indicates the size of the audience exposed to your message.

- Engagement Rate: Tracks the number of likes, shares, comments, and interactions on the influencer’s posts. A higher engagement rate suggests that the content resonates well with the audience.

- Click-Through Rate (CTR) from KOL Content: Measures how many people clicked through from the KOL’s content to your website or landing page. This helps gauge the direct traffic generated by the influencer’s endorsement.

- Leads or Conversions from KOL Campaigns: Tracks the number of leads or inquiries generated from a KOL’s campaign, especially if the content includes a direct call-to-action (e.g., to download a white paper or sign up for a webinar).

- Follower Growth After Collaboration: Measures the increase in your brand’s followers on platforms like WeChat or Zhihu after collaborating with a KOL. This reflects the long-term impact of influencer engagement.

- Sentiment Analysis: Evaluates the tone and sentiment of the comments and discussions generated by the KOL’s content. Positive sentiment indicates that the audience views the collaboration and your brand favorably.

1.7 Douyin Metrics:

- What It Measures: Video views and engagement rates by different audience label groups and lead-generation performance.

- How It’s Different: 51% of Douyin users in China are over 30-year old. Unlike its counterpart TikTok on global markets, Douyin in China has more matured audience groups including business decision makers and entrepreneurs. Douyin’s user base also heavily overlaps with decision-makers in industries like tech and healthcare, making it a valuable B2B platform. B2B brands are leveraging this platform to conduct both branding and lead-gen activities through in-feed video adverts.

- Key metrics:

- Precise reach to your target audience groups: track the performance from different target groups powered by Douyin’s powerful precision targeting capabilities: demographic, location, interest tags, behaviour history etc. Are you ads reaching the ideal target profile?

- Click-Through Rate (CTR)

- Average viewing duration of your video ads

- Cost per lead

- Lead quality: transparent communication between marketing, sales and marketing suppliers to continuously monitor lead quality throughout the campaign, rather than waiting until it finishes.

1.8 PR and Media Coverage Metrics (Impressions, Mentions, Engagement)

- What It Measures: The reach and engagement of PR or advertorial articles published in mainstream Chinese media outlets (e.g., Tencent News, Sina, NetEase etc.).

- How It’s Different: Mainstream media in China can have a significant impact on public perception, and PR campaigns often include a mix of advertorial content to build trust and credibility. Earned media coverage is very hard to get especially for foreign brand, as an alternative paid advertorial campaigns on mainstream and industry media are seen as a common practice.

- Key Metrics:

- Number of media mentions

- Number of high-quality media outlets

- Number of Baidu collects

- Audience coverage

1.9 Offline Event Metrics

- What it Measures: In China’s B2B sector, offline events like industry conferences, trade shows, and networking gatherings play a critical role in building relationships, showcasing expertise, and establishing trust with potential clients and partners. Measuring the success of these events requires a combination of traditional and digital metrics.

- How It’s Different: China’s offline events have broken the boundary between offline engagement and online activities. Unlike email invitations in Western markets, pre-event online warm-up campaigns on WeChat play a critical role in driving awareness and registration. During-event digital assets sharing, immediate capture of contact info through WeChat and post-event advertorial / video coverage are also crucial as such activities take offline events to online.

- Key Metrics:

- Pre-event impression and engagement through online promotion

- Event attendance

- Contacts collected: QC code scans and WeChat exchanges

- Quantity and quality of leads

- Post-event media coverage

- Offline to Online Conversion Rate: Measures how many of the leads collected during the offline event take an online action afterward, such as visiting your website, downloading a white paper, or signing up for a demo.

Relationship Metrics

Success in China requires tracking relationship development alongside traditional sales metrics. Companies should monitor the quality and depth of relationships being built, including the number of meaningful interactions, participation in industry events, and engagement with thought leadership content. The speed at which relationships move from initial contact to trusted partner status is a crucial indicator.

Lead Quality Assessment

Continuous monitoring of lead quality throughout campaigns is essential rather than waiting for campaign completion. Clear communication between marketing, sales, and marketing suppliers helps maintain focus on generating qualified leads. Companies should track both the quantity and quality of leads across different channels and campaign types.

Market Response Monitoring

Successful companies maintain flexible strategies that can adapt to market changes and competitive moves. Regular monitoring of competitor activities, industry trends, and regulatory changes helps inform strategic adjustments. Companies should establish clear protocols for implementing strategic changes based on market feedback.

Implementation of a systematic approach to gathering and acting on market feedback ensures continuous improvement of marketing efforts. Regular strategy reviews should examine both short-term performance metrics and progress toward long-term relationship-building goals. Companies should maintain documentation of lessons learned and best practices to inform future campaigns.

Case study – Success from a bespoke funnel plan for the China market

With our support, Premier Research was a resounding success at the Drugs Information Association (DIA) conference, achieving outstanding results and quality leads.

Premier Research entered China market comparatively late and needed to cut through the noise from established global competitors and local competitors in China. As an extension of their global marketing and China sales team, we built their China strategy and roadmap from scratch, then landed and expanded their marketing footprints in China.

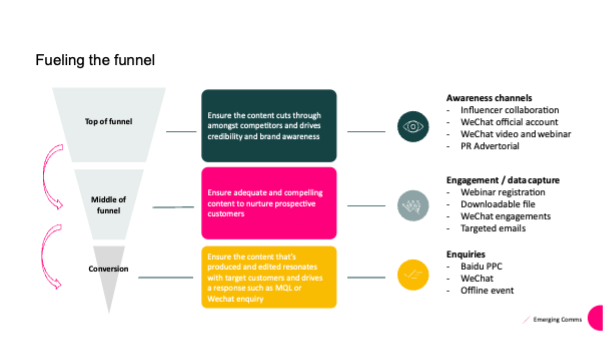

Building and fuelling the funnel

Ensuring a robust presence across various touchpoints was essential for effectively convey the brand’s visibility through a well-coordinated multi-channel approach. It enables potential customers to seamlessly engage with brand and articulate their demands.

The successful execution of this funnel strategy is built upon strong alignment and on-going joint efforts between Premier Research’s global marketing team, in-market China sales reps and our highly experienced B2B marketing professionals in Emerging Comms.

B2B Clients we’ve helped in China

- Premier Research: 360 degree marketing activation

- ASM: Corporate brand communication and employer branding

- Great Ormond Street Children’s Hospital: Marketing to industry professionals and Chinese paediatricians

- EUA: Brand localization and lead-gen strategy

- GEA: Social media optimization

- Power Screen: Website and content localization

- Elsevier: Market research and content marketing strategy to reach out to niche academic procurement decision makers

- University of Manchester: Precise targeting campaign to engage with senior academia and researchers in China

- ProClinical: China content solution for a global chemistry industry recruiting service provider

- Bloomberg: China market competitor analysis and localized marketing solution

Conclusion

Success in China’s B2B market requires a comprehensive approach that combines digital excellence with traditional relationship building. The most successful companies maintain flexibility in their strategies while staying committed to long-term relationship development. Regular review and adjustment of strategies ensure alignment with market dynamics and company objectives.

Companies must remember that China’s B2B market continues to evolve rapidly, with new opportunities emerging in areas like green technology, healthcare innovation, and advanced manufacturing. Success requires balancing digital sophistication with traditional relationship-building skills while maintaining authentic engagement across multiple channels.

Next Steps…

At Emerging Comms, we specialize in helping global B2B brands enter and grow in the Chinese market. Contact us today for a personalized consultation and learn how we can help you drive success with a tailored marketing strategy for China.